Will Social Security Stay Solvent Beyond 2033?

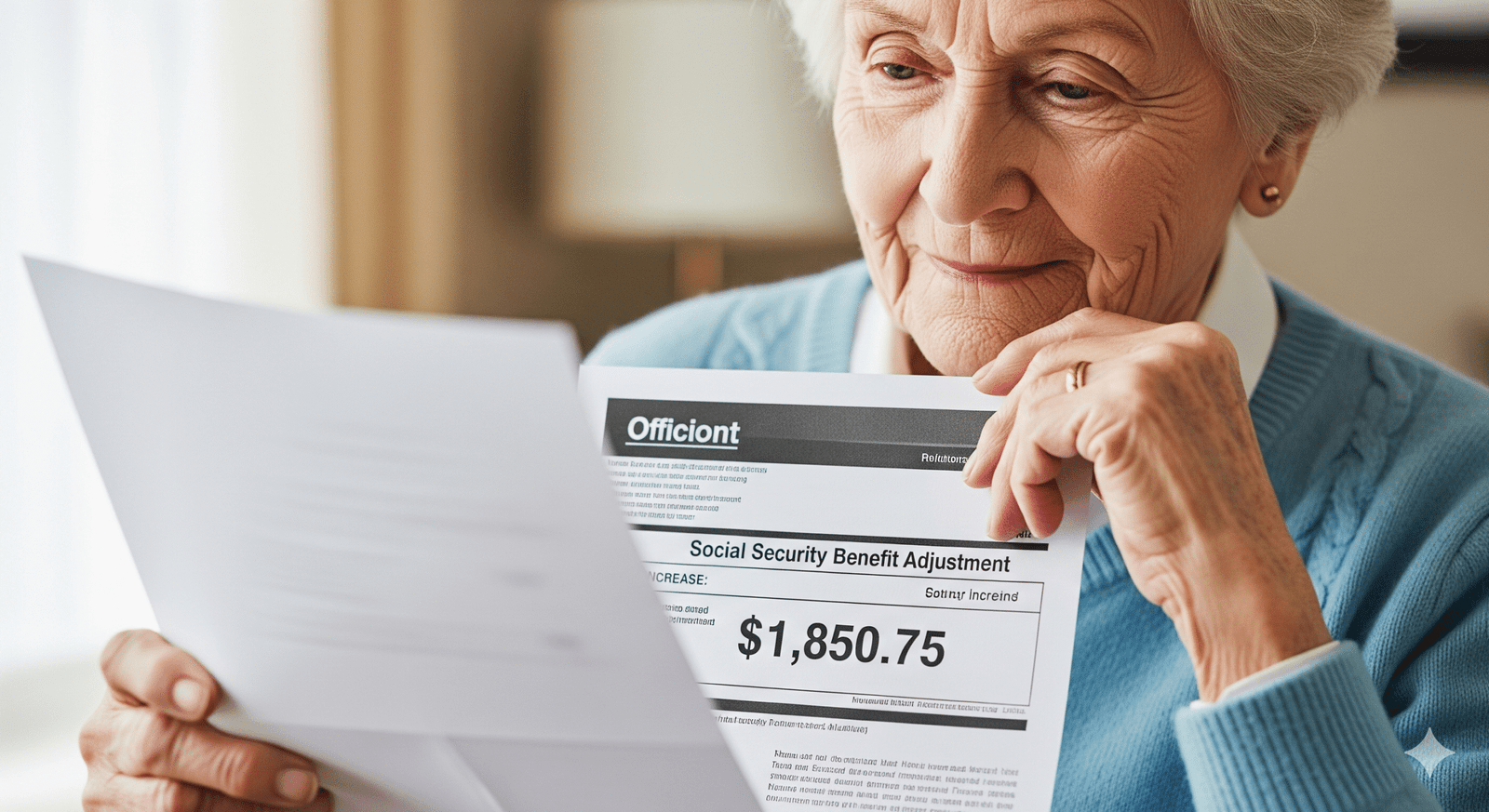

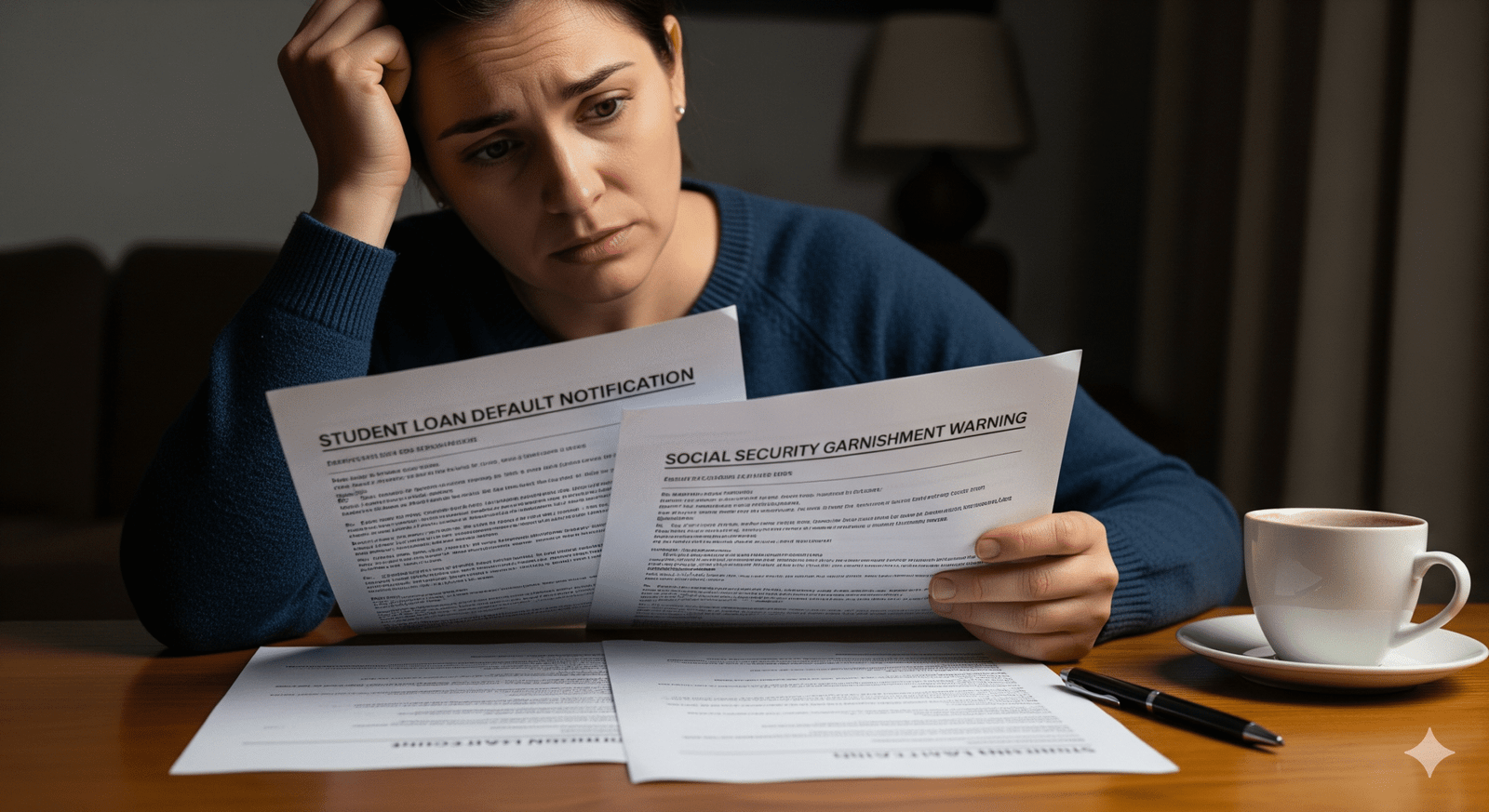

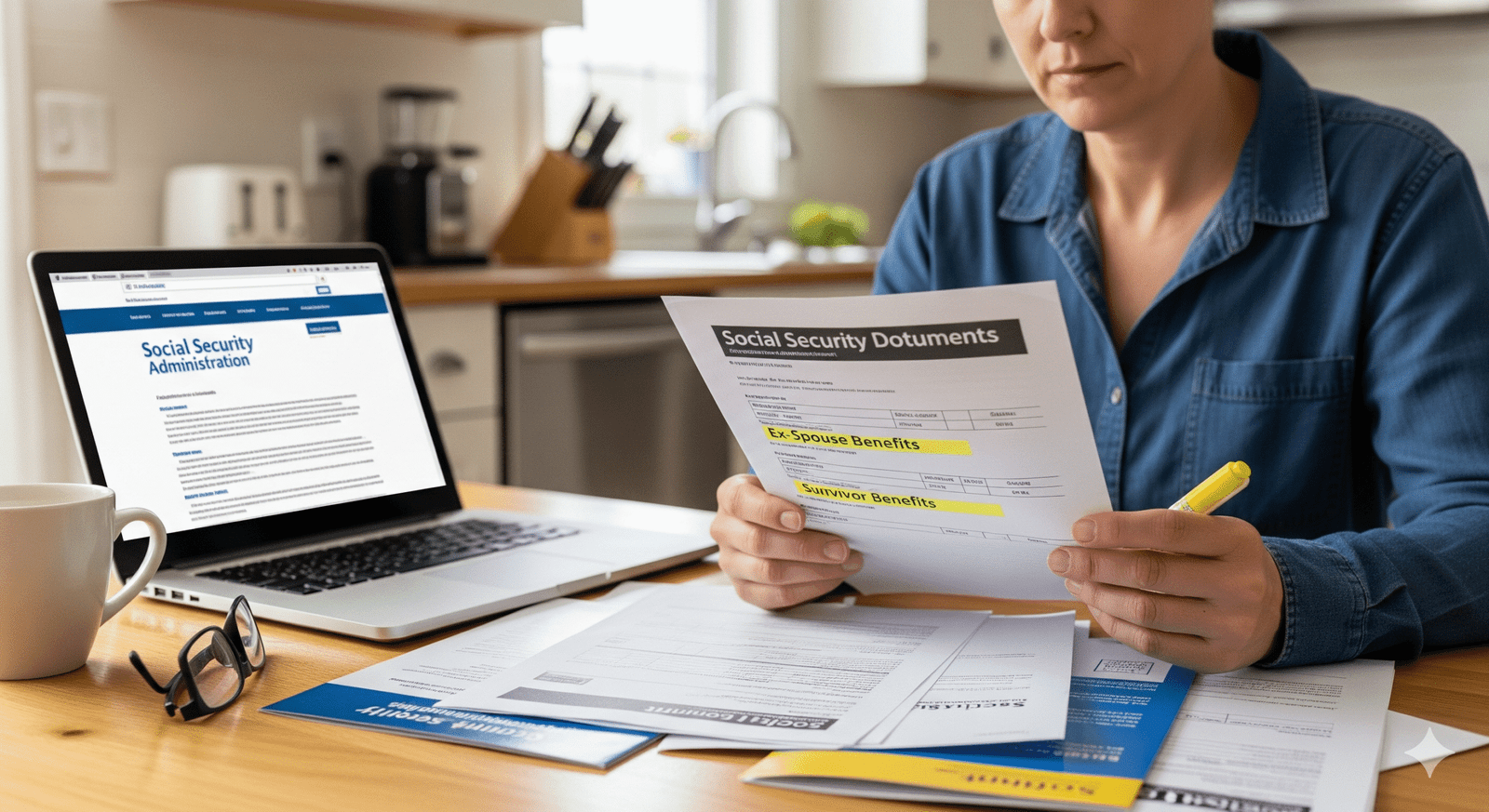

Social Security turned 90 in 2025—but its future is uncertain. The big question on the minds of millions of Americans is: Will Social Security run out in 2033? The short answer is no, but benefits could be significantly reduced if reforms aren’t made soon. Here’s everything you need to know about the solvency of Social … Read more